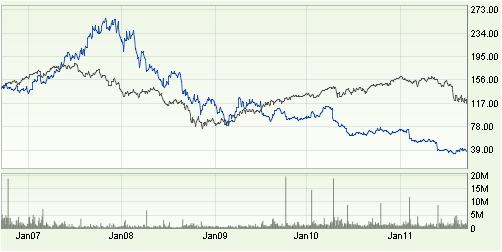

In 2005, Nokia was the fifth most valuable brand in the world. With a turnover of 51,1 billion euros in 2007 and an operating profit of 8 billion euros, the company’s market share had climbed well above 40 percent.

At this point, most mutual funds had invested significant shares of their funds in Nokia, probably in order to balance the portfolio vis-à-vis the stock market index. As a consequence, the company’s stock was traded around P/E 15-20, a rather high number considering the size of the firm and its meager growth prospects. When this is the case, and financial institutions keep buying a stock, it is usually the beginning of a collapse. This holds true for IBM in the late 1980s, Ericsson in the late 1990s and banks in 2006-2007.

In these years, politicians around the world argued that their country needed “a new Nokia” – a company which does so well that it fuels an entire economy’s growth over many years. Well, today anyone can have a Nokia. The final sign of things to come was a statement in BusinessWeek 2007: ”Nokia’s dominance in the global cell-phone market seems unassailable.”

The firm collapsed in the coming years its new CEO Stephen Elop stated in 2007 that ”the first iPhone shipped in 2007, and we still don’t have a product that is close to their experience. Android came on the scene just over 2 years ago, and this week they took our leadership position in smartphone volumes”.

How can such a sharp decline be explained? And why has Nokia struggled to develop a competitive smartphone?

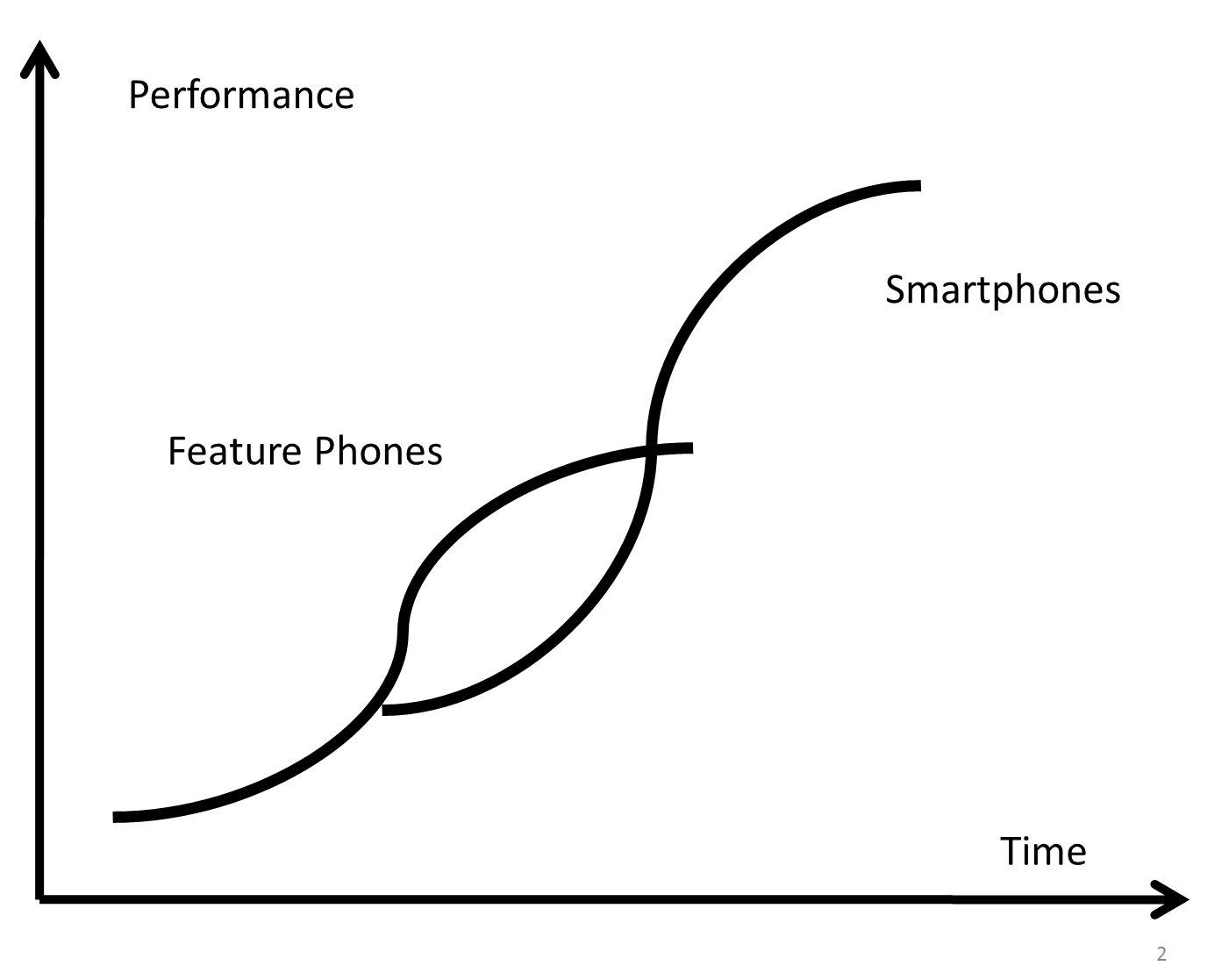

Technology S-curves provide a good starting point for addressing this issue. The S-curve theory posits that the advance of a technology is initially slow. Once a breakthrough occurs, performance increases rapidly until a particular solution has reached its limits of what is possible within a certain paradigm. At this point, the S-curve levels off and the technology becomes increasingly vulnerable and likely to be substituted by another technology S-curve.

Nokia essentially surfed on the S-curve related to hardware and feature phones. Over the years, new functions were crammed into thinner and cheaper phones: radios, cameras, music players, recording capabilities, etc were added. Along this S-curve, Nokia could fend off competitors easily. Being late with the introduction of camera phones, the company could still catch up thanks to its financial resources and engineering capabilities related to hardware.

While the pace of development has been stunning for feature phones in the 2000s, it all happened along an established technological trajectory. As long as competition centered around offering a broad portfolio of feature phones, Nokia was in control. In this sense, Business Week was right when stating in 2007 that “Nokia’s dominance in the global cell-phone market seems unassailable”.

Approximately at this point in time, the S-curve for feature phones started to level off. It now became increasingly difficult to add valuable technological features or create additional consumer benefits along this trajectory.

Why then has Nokia been so slow in its shift to the next S-curve related to smartphones?

Nokia’s main problem is probably related to the fact that the competencies it developed in the feature phone era were not only less useful for developing smartphones – they were probably downright destructive for such attempts:

Nokia had never been a software company. Competencies were more related to hardware. Its operating system, Symbian, was essentially designed for phones used for calling and sending text messages, the online functionality of Nokia phones remained poor. A smartphone is much more about software and online compatibility than a feature phone. Hence, Nokia was in fact ill equipped to develop smartphones as its competencies were more related to hardware.

Having an established set of competencies related to feature phones, it became financially rational to continue along this trajectory and capitalize on these skills. A large company with a large established market where customer needs are known usually struggle to allocate resources to breakthrough innovations. Such a firm faces a high opportunity cost and therefore it is not able to renew itself. Big companies think big, but all novelties, by

definition, start as something small.

Rumors abound that Nokia was considering the development of a touch screen smartphone five years ago. The inability of large companies to invest in unknown technologies and unknown needs is probably the reason why Nokia never did so.

Looking ahead, Nokia is facing formidable competition and the company is still not prepared for it, considering that its competencies are still largely stuck in the feature phone paradigm. At first glance, the collaboration with Microsoft makes a lot of sense as Nokia lacks the required software skills. However, Microsoft has never been a dominant player in mobile operating systems.

Bearing in mind that Nokia’s smartphone Lumia will have significantly fewer applications available for its customers also means that the company is in trouble. Small installed base of customers means that fewer companies are willing to develop applications for Lumia, which in turn means that fewer customers are willing to buy a Lumia, which in turn means… Vicious circle.

Warren Buffett once said “turnarounds don’t turn”. This is probably the case for Nokia.

Summing up: competencies have become incompetencies. A fish is very well suited for survival in the water. Now put it on land and see what happens.

Lämna ett svar